What is a balance transfer and how does it work?

Key takeaways:

- A balance transfer can help you save money by moving high-interest credit card debt to a card with a lower interest rate, often with 0% promotional periods.

- By using a balance transfer to consolidate multiple credit card balances into one payment, you can simplify your finances and potentially pay off debt faster.

- While balance transfers typically involve fees, the interest savings during promotional periods can outweigh these costs when managed strategically.

Many Americans who carry credit card balances pay hundreds of dollars in interest charges each month. This expense can strain monthly budgets and hamper progress toward financial stability. Fortunately, there’s a budget-friendly solution: a credit card balance transfer. This tool offers a way to make considerable progress toward debt elimination while keeping more money in your wallet.

Balance transfers explained

A balance transfer is the process of moving an unpaid balance (or a portion of a balance) from an existing credit card or loan to another credit card with a lower interest rate.

Benefits of a balance transfer

A balance transfer can be a smart way to manage your money and reduce financial stress. Here’s how transfers can work for you:

- Take advantage of a lower interest rate, potentially saving you money on total interest charges.

- Pay down balances faster, freeing your money for other financial goals.

- Consolidate multiple monthly payments and due dates into a single payment, helping to lower your overall monthly expenses and simplify your finances.

A poor credit history can limit access to such benefits, but there is another option. A reputable credit counseling agency opens in a new window can help negotiate new rates on your existing accounts and provide other debt management services.

How does a balance transfer work?

A credit card balance transfer is a straightforward process that typically involves three simple steps.

Step 1: The offer

The balance transfer process often starts when a person is notified that they’ve been pre-approved for a new credit card or receives a balance transfer offer from a current or new credit card issuer.

The offer may feature a low or 0% interest promotional rate. The promotional interest rate may be valid for a specific period, such as 6, 12, or 18 months. Always read the terms so you know what else may change beyond the teaser rate when the introductory period ends.

If you haven’t received an offer, you can also contact your current bank or credit card issuer to see if they’ll match terms in order to keep your business or visit your nearest Commerce Bank branch to check your eligibility for a lower interest rate credit card.

Step 2: The approval

Once you have chosen (and are approved for) a card to move your balance to, inform that credit card company of the amount you’d like to transfer, along with the account number and bank name of the originating account. You can usually transfer funds online, through a mobile app, by phone, or with a balance transfer check from the card issuer.

You may incur a balance transfer fee which is usually calculated as a flat fee or percentage of the transferred amount.

Step 3: The transfer

The credit card issuer you’re transferring to will handle the balance transfer. Processing may take several weeks to complete. You must continue making payments on your current accounts to avoid late fees.

What to consider before initiating a balance transfer

Maximizing the benefits of a balance transfer requires careful planning. Here are a few things to remember as you begin the process:

- Since a balance transfer can affect your credit score, it’s advisable to use less than 30% opens in a new window of your total available credit.

- There may be fees involved, either a flat fee or a percentage of the transfer (which could be as high as 5%.) Paying the fee may be worth it when the fee is low compared to your interest savings, but it does factor into the total cost.

- Banks usually don’t allow balance transfers to another card within the same bank.

- A late payment will probably result in a late fee, but it may also cause you to lose your promotional interest rate. The lender could even impose a penalty APR, which is even higher than the card’s normal rate. Read the terms and conditions of your agreement to understand what the specific consequences of a late payment can be.

- Commit to a plan to pay off the balance during the promotional period to avoid higher interest on any leftover amount.

- Don’t use your balance transfer card for new purchases — you won’t get the same grace period on interest. It’s better to use a completely different card until your transfer balance is paid off.

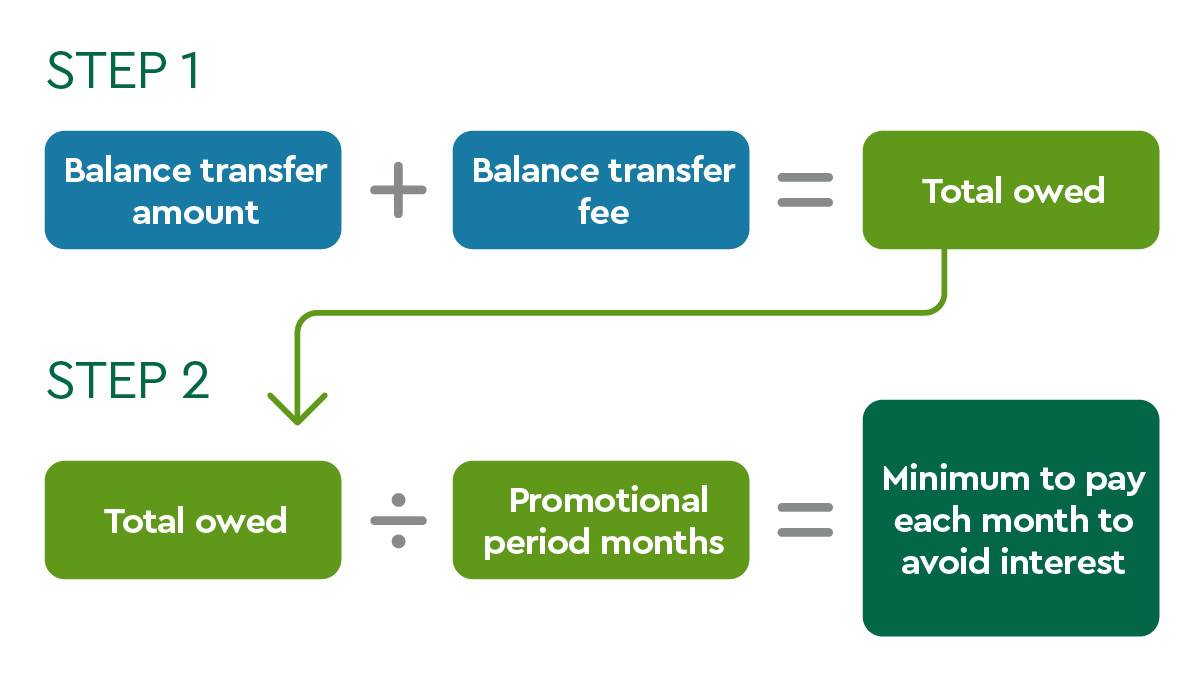

Remember that if you can’t pay off the remaining balance by the end of the promotional period, any remaining balance will be charged interest at the regular rate. Plan your payments so you can pay off the entire amount to completely avoid paying interest. Do this by adding the total amount you transferred and the balance transfer fee, then divide that total by the number of months in the promotional period. The result is the minimum amount to pay each month to pay off your transfer before your rate expires.

A credit card balance transfer can be a smart way to consolidate higher interest debt and pay it down faster. Learn more about Commerce Bank’s current credit card balance transfer offers online or contact us directly for more information.