How to understand your bank statement.

Key takeaways:

- Reviewing your bank statement regularly helps you track spending, catch unauthorized charges, and avoid financial mistakes.

- Familiarizing yourself with the structure of a bank statement, including transaction details and fees, is key to effective financial management.

- Setting up account alerts and using mobile banking tools allows for real-time monitoring, providing greater control over your finances.

Many people, especially those getting their first bank account, find bank statements confusing and overwhelming — so much so that reviewing them can easily fall to the bottom of a financial to-do list. However, learning to read bank statements is one of the most important money skills a young person can develop. Here’s what you need to know about reading your bank statement like a pro.

What is a bank statement?

A bank statement is a detailed report of how you’re managing your finances. It shows everything that happened with your money during a specific time period, usually one month. Statements may include a record of every time money came into your account (like your paycheck) and every time money went out (like when you bought coffee or paid rent).

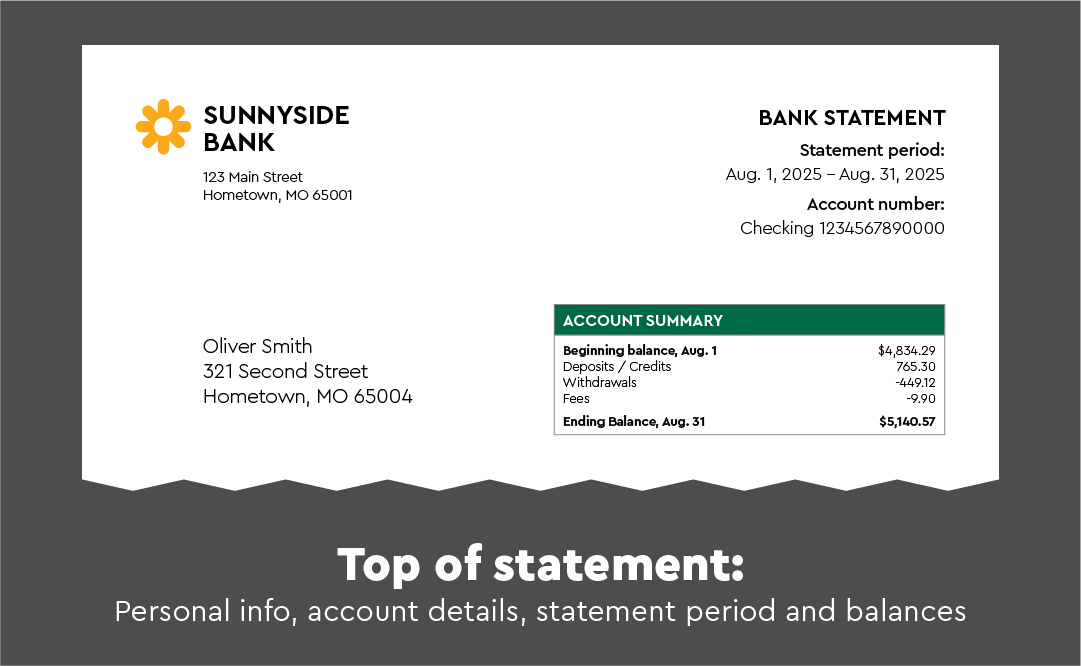

The top of your statement shows:

- Your personal info: your name, address and phone number. Make sure this is correct.

- Account information: your account number and type (e.g., checking, savings, or money market).

- Statement period: the exact dates covered, like “March 1 - March 31, 20##.”

- Beginning and ending balance: how much money you started and ended the statement period with.

Understanding your transactions.

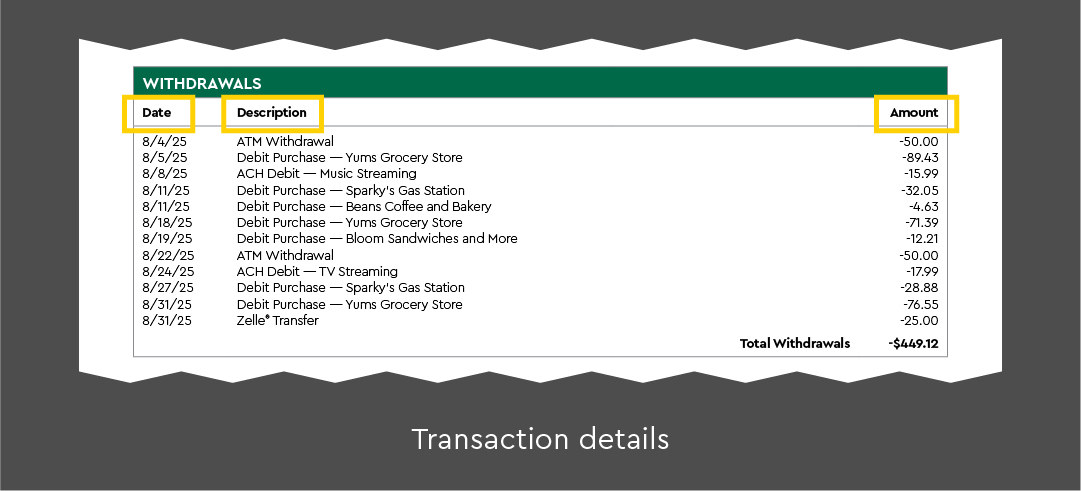

The middle section shows every transaction with these details:

- Date: when the transaction happened or was processed.

- Description: what it was for (store name, ATM withdrawal, direct deposit).

- Amount: how much money was used in the transaction. Deposits show as positive, withdrawals as negative.

Understanding the types of transactions you might see on your bank statement is essential for managing your finances. Each transaction provides key details that can help you track your spending, identify patterns, and spot any irregularities.

Here is a breakdown of common transaction types:

- Direct deposit: your paycheck is automatically deposited.

- Debit card purchase: buying something with your card (groceries, gas).

- ATM withdrawal: cash you took out.

- ACH debit: automatic payments like streaming services, rent or student loans.

- Online transfer: sending money through Zelle® link opens to a Commerce Bank page or to another financial institution.

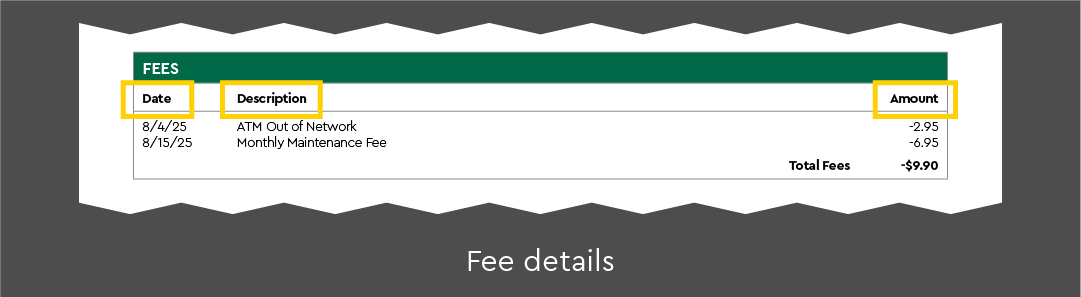

Managing your finances effectively involves understanding the various fees that can impact your account. By being aware of these common charges, you can make better decisions and avoid unnecessary costs.

- Overdraft transfer fee link opens to a Commerce bank page: $13 when you spend more than you have and money is transferred from a linked account to cover the transaction. Fees vary by financial institution and overdraft service.

- Monthly maintenance fee: some accounts charge monthly, but your banker can let you know how certain fees can be avoided.

- ATM fee: using ATMs outside your bank’s network. Fees vary by financial institution.

- Returned check fee: writing checks without enough money in your account to cover them. Some financial institutions may refer to this charge as a “bounced check fee” or “non-sufficient funds (NSF) fee.” The financial penalty varies by financial institution.

Ensure you recognize every charge shown on your bank statement. Spotting suspicious charges early is one of the best ways for you to protect your finances from fraud.

- Multiple small charges: Scammers sometimes start with tiny amounts hoping you won’t notice.

- Duplicate charges: The same purchase shows up twice.

- Unknown transactions: anything you don’t remember buying.

- Subscription increases: companies raising prices without clear notice.

If you see any issues, contact your bank immediately. A representative can guide you on steps to take to secure your account.

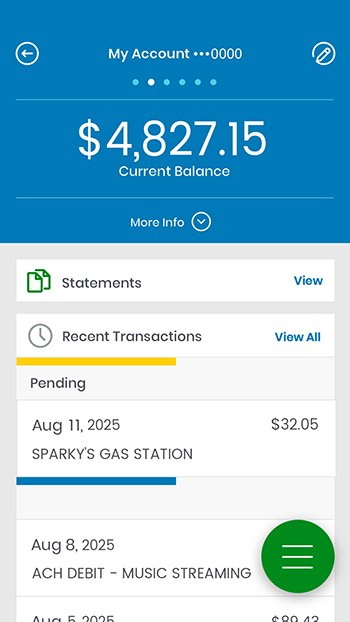

You don’t have to wait for your monthly bank statement to check on your accounts. Sign up for free text or email alerts link opens to a Commerce bank page to monitor your Commerce accounts daily. Push notifications in the Commerce Bank Mobile App are also available. These options allow you to receive real-time notifications of changes to your accounts.

Reading your bank statement might seem boring, but it’s one of the best ways to take control of your money. Start by spending just 10 minutes each month reviewing your statement. Once you get the hang of it, you’ll feel more confident about your finances and catch problems before they cost you money.

Disclosures:

To view or print a PDF file, Adobe® Reader® 9.5 or above is recommended. Download the latest version.